Know Your Business (KYB): All That You Need To Know

⚡ Key Takeaways

- Know your business (KYB) is a comprehensive process that verifies a company’s legitimacy.

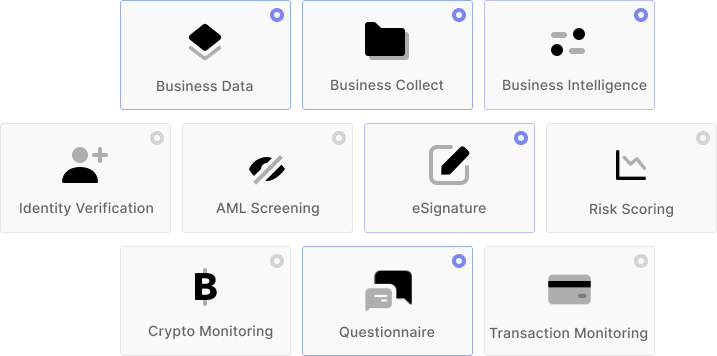

- KYB is usually an orchestration of multiple products such as Know Your Customer, Risk Scoring and Onboarding.

- It’s vital that businesses properly check and validate company information with legitimate sources.

- Cellbunq helps clients meet all KYB requirements and allows the customers to be onboarded quickly.

As we look deeper into the digital age, the risk of financial crimes increases. This necessitates the implementation of stringent verification measures such as Know Your Business (KYB). Originally an offshoot of the Know Your Customer (KYC) process, KYB has emerged as a robust verification standard that fortifies the global financial system against illicit activities.

What is Know Your Business (KYB)?

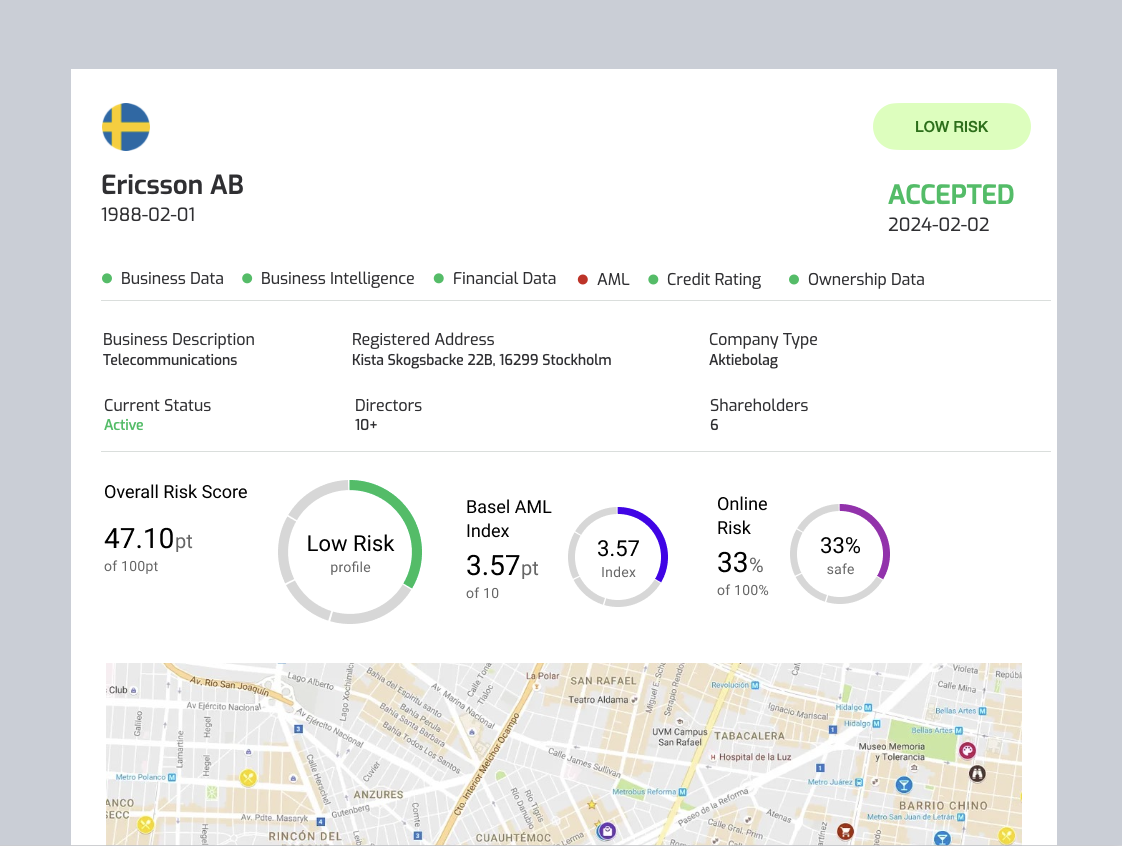

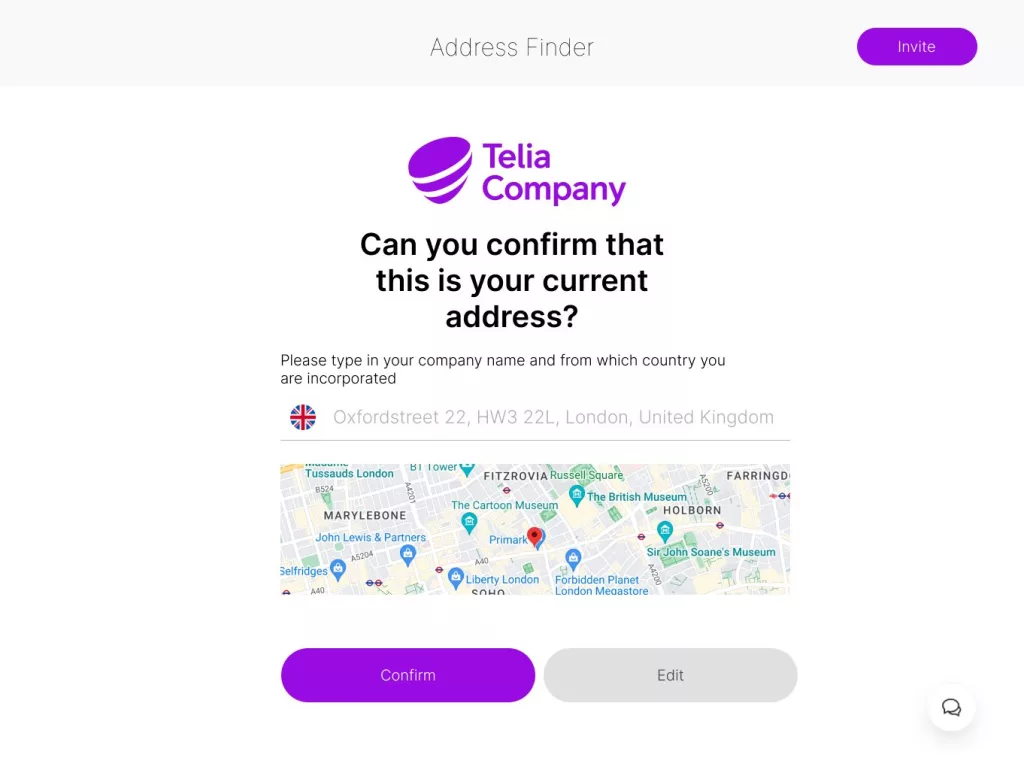

KYB is a comprehensive process that verifies a company’s legitimacy before entering into a business agreement with them. It entails a thorough examination of various aspects such as the company’s physical address, phone number, business registration, source of funding, and risk assessment based on their location.

KYB is not just about verifying the company’s legitimacy; it also involves identifying the Ultimate Beneficial Owners (UBOs) who directly profit from the company’s earnings. This transparency mechanism plays a significant role in deterring criminals from utilizing businesses as a cover for illegitimate funds.

When it comes to Know Your Business (KYB) it can look different based on multiple factors such as geography, regulatory requirements, and risk acceptance but below you will find the most common pillar-stones for what a standard KYB is about.

The Background of Know Your Business

KYB, in essence, is an extension of KYC, which has been a standard anti-money laundering (AML) obligation for decades. The U.S. Patriot Act of 2001 introduced KYC to detect and prevent terrorism financing activities. However, it overlooked the regulation of chamber regulators. This loophole was exploited by financial criminals, triggering the inception of KYB in 2016 to close this gap. [1]

The Importance of KYB Compliance

KYB compliance is integral to safeguarding a company’s interests. It ensures that a company does not unknowingly engage in business with entities involved in money laundering, terrorism financing, tax evasion, or other financial crimes.

Beyond legal considerations, businesses must ascertain the UBOs of their potential partners. This is crucial in preventing the use of shell companies and ensuring that the company’s profits are not being misused. Companies that fail to meet KYB requirements face severe penalties, including hefty fines and imprisonment for more egregious offenses.

The KYB Procedure

Complying with KYB procedures necessitates the collection and analysis of a vast array of data on other businesses. This includes company addresses, registration documents, licensing documentation, and identities of directors and owners.

One of the pivotal aspects of KYB is the verification of UBO. This process ensures that companies are not being used for illegal activities and reduces the risk of fraud in their accounts.

Who Needs to Conduct KYB?

The KYB process is mandatory for various institutions, including banks and other financial institutions. Companies that engage in business transactions with other businesses, such as suppliers, vendors, and partners, also need to perform KYB checks. [2]

The Role of Automation in KYB Compliance

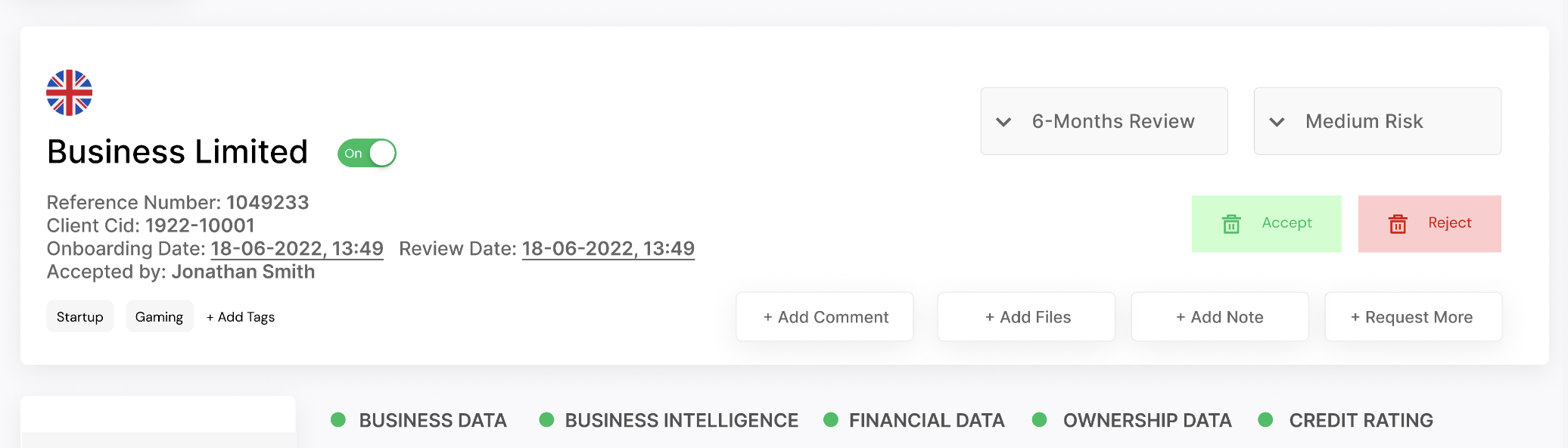

Performing KYB checks manually can be time-consuming and error-prone. Fortunately, the advent of automation has revolutionized KYB compliance. Automated KYB compliance uses electronic identity verification (eIDV) to streamline the verification process, making it faster and more efficient.

KYB in Today’s Day & Age

The digital age has heightened the need for KYB compliance. Automated KYB solutions have made it possible to perform checks in seconds, reducing the risk of human error and making the process more efficient.

These solutions use public records and private databases to verify an entity swiftly. The integration of digital tools and legal verification procedures continues to evolve, bolstering businesses’ ability to comply with regulations and mitigate fraud risks.

KYB is not just a regulatory requirement; it’s a fundamental business practice that promotes transparency and trust. By understanding the nature of the businesses they engage with, companies can protect themselves from financial crimes and enhance their reputation — a critical factor for success in the modern business landscape.

Our Final Remarks

In a world where financial crimes are increasingly sophisticated, KYB serves as a critical line of defense. It not only protects businesses from potential financial losses but also upholds their integrity in the face of regulatory scrutiny. As KYB continues to evolve in response to technological advancements and regulatory changes, businesses must stay abreast of these developments. Only then can they safeguard their interests and contribute to the broader fight against financial crime. [3]

FAQ

Is KYB more of an orchestration than a product?

Yes, Know Your Business (KYB) can look different for various clients, and it is usually a combination of various products such as KYC, Risk Scoring, AML Screening, and Business Data.

What is the difference between KYC and KYB?

KYC usually refers to an individual that you are verifying, while KYB refers to a business that you are verifying.

Does Cellbunq offer KYB?

Yes, we offer all building blocks including Business Data to be able to perform accurate and real-time KYB of your clients.

References

[1] fincen – USA PATRIOT Act | FinCEN.gov. https://www.fincen.gov/resources/statutes-regulations/usa-patriot-act [2] fca – Money laundering regulations. FCA. https://www.fca.org.uk/firms/financial-crime/money-laundering-regulations [3]handbook – SUP Verification of firm details – FCA Handbook. https://www.handbook.fca.org.uk/handbook/SUP/16/10.html

Good job! Please give your positive feedback

How could we improve this post? Please Help us.